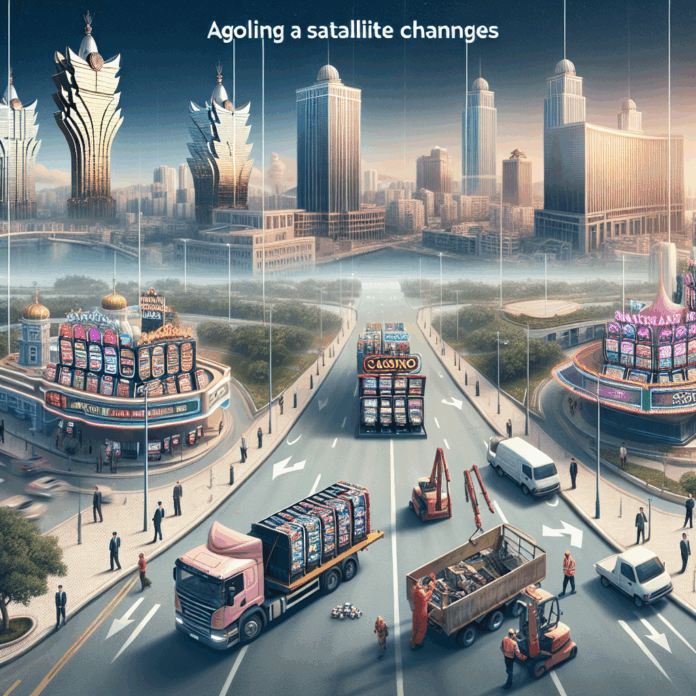

Macau’s gaming landscape is entering a decisive phase as three major concessionaires prepare to close 11 satellite casinos by December 31, 2025, marking the end of a transitional model that has long shaped the city’s casino economy. The move, announced officially by the Macao SAR Government on June 9, 2025, forces a rapid consolidation of operations and signals a shift toward integrated-resort control under revised gaming rules. Macao SAR Government announcement

What changed – regulatory deadline and operator responses

Under amendments to Macau’s gaming law (Law 7/2022), a three-year transitional period for so-called satellite casinos – venues run by third parties under concessionaire licences with revenue-sharing arrangements – expires on December 31, 2025. In filings and public statements this year, SJM Resorts, Melco Resorts and Galaxy Entertainment notified regulators that they will terminate operations at 11 satellite sites ahead of that deadline for commercial and compliance reasons.

Companies have already disclosed concrete closure plans. Melco said on June 9 it will cease operations at Grand Dragon Casino and three Mocha Club venues before year-end and redeploy gaming machines and tables to its integrated resorts. SJM and Galaxy have likewise moved to wind down multiple satellite properties, including well-known downtown venues such as Ponte 16 and Casino Grandview.

Impact on workers, revenue and the broader market

The government emphasized that concessionaires must “properly settle the employees affected by the closure” and said it will closely monitor the transition. Authorities estimate thousands of roles will be shifted back to concessionaires’ main properties – the government reported earlier in 2025 that several closures already led to reassignments and that a hotline for affected workers had been activated.

For operators, the closures change revenue mechanics – moving away from third-party revenue-sharing arrangements toward direct management or management-fee models under the revised framework. The consolidation comes as Macau’s overall Gross Gaming Revenue has rebounded through 2025, with reports showing continued year-on-year growth in months including November – a reminder that operators are balancing regulatory change with a recovering mass-market demand for gaming and nongaming experiences.

Analysts say the short-term costs include relocation logistics, repurposing of equipment and potential redundancy payouts – offset by longer-term benefits of tighter brand control, operational synergy across integrated resorts and clarity over licence compliance. Investors have already reacted in public markets to these moves, and executives have framed the closures as part of strategic optimization rather than retreat from Macau’s core market.

What to watch next

Key items to follow in the coming months include the precise timelines for each venue shutdown, how swiftly affected employees are reassigned and whether any local governments or community groups press for additional worker protections. Regulators’ oversight will be critical as operators reallocate assets and seat capacity among flagship properties like City of Dreams, Studio City and other integrated resorts.

The December 31, 2025 deadline marks a turning point for Macau’s post-pandemic gaming industry – one that could reshape the city’s downtown gambling footprint and reaffirm the dominance of large integrated resorts as primary engines of tourism and gaming revenue. Observers should monitor company filings and government updates for confirmation of closure dates, employee settlement figures and any policy adjustments that might emerge as the wind-down proceeds.